Bitcoin Unveiled: Is Digital Gold the Future of the Global Currency Revolution?

The first cryptocurrency, Bitcoin, has absolutely modified the financial scene by presenting a secure, obvious, and decentralized technique of doing commercial enterprise. Bitcoin was created in 2009 through the enigmatic Satoshi Nakamoto, has triggered an economic revolution by upending the hooked-up banking gadget and converting the way that money is thought of. It is at the forefront of this shift as the arena will become extra digitalized, providing each opportunity and problem.

Describe Bitcoin.

A centralized government or authority is not required for Bitcoin to characteristic as a decentralized digital money. Blockchain technology is the foundation of it, in comparison to conventional currencies, which can be issued and controlled via critical banks. This era data every transaction over a dispersed community of computer systems, acting as a public ledger. Each transaction is tested by community nodes via cryptography, causing bitcoin to be extraordinarily secure and resistant to fraud.

One of the most prominent traits of bitcoin is its restricted supply. There will be only 21 million bitcoins in existence, a design feature that makes it a deflationary belonging. This deficiency is one of the reasons that bitcoins are regularly called “virtual gold.”. The finite deliver is hastily opposite with fiat currencies, which can be published in a will by way of critical banks, likely leading to inflation.

How does bitcoin work?

Bitcoin’s transactions are completed at once among customers without the need of middlemen. This Peer-to-peer network lets in faster and extra-powerful transfers than traditional banking systems. The transaction is verified via a manner referred to as mining by community nodes, where powerful computer systems remedy complicated mathematical puzzles. Once verified, the transaction is added to the blockchain, making a permanent and tamper-proof record.

Mining not only protects the network but also introduces new bitcoins into circulation. Miners are rewarded with bitcoin for their efforts, but the reward is known as “Halling” in an event almost every four years. This mechanism ensures that the supply of new bitcoins decreases over time, which increases its deficiency and value.

Bitcoin’s Benefits

• Decentralization: It acts independently of any central authority, reducing the risk of government interference or manipulations

• Security: Transactions are protected by cryptographic algorithms, which makes them extraordinary evidence against cheating and hacking.

• Transparency: When a blockchain ledger is publicly reached, it ensures that each one can prove with the help of all people.

• Global Accessibility: It can be dispatched and obtained anywhere inside the international, imparting monetary offerings to unbanked populations.

• Inflation Hedge: With a set deliver, it is seen as a hedge towards inflation and forex devaluation.

Challenges Facing Bitcoin

Despite its several blessings, it isn’t without its challenges. Price volatility is one of the most important issues, making it a volatile funding. Additionally, regulatory uncertainty in various countries can impact its adoption and cost. The environmental impact of its mining, which consumes large quantities of strength, is every other trouble that has garnered grievance.

Recent Posts

Bitcoin’s Price History

Bitcoin’s Price History

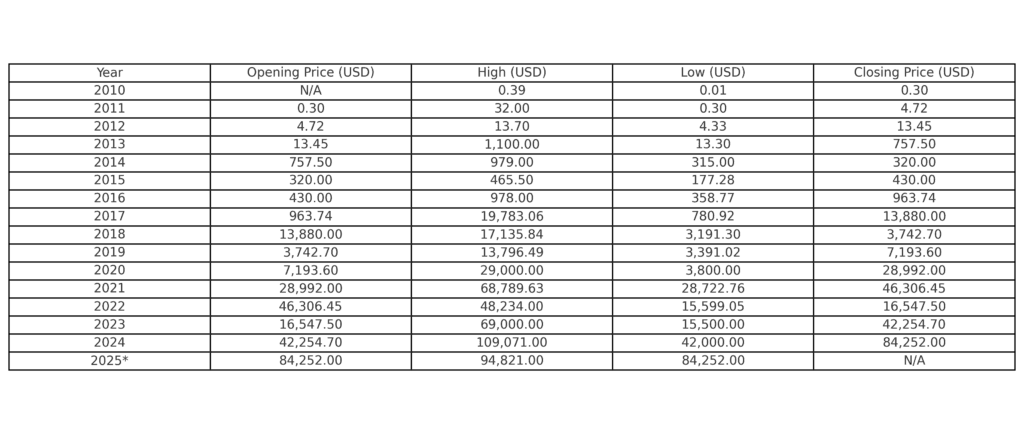

Its charge history is a testament to its unstable nature. The table below highlights some considerable rate milestones:

If you want to read more about price history, click on the below-given link:

Read More Articles:

https://www.nytimes.com/topic/subject/bitcoin

https://www.brookings.edu/articles/the-brutal-truth-about-bitcoin/

Future of Bitcoin

The future of Bitcoins stays a subject of a whole lot debate. Some consider that it becomes an international reserve foreign money, while others argue that it will remain a speculative asset. What is clear is that it has already left a considerable mark on the global economy. As more businesses and institutions embody it, its utility and value are possibly to grow.

Advances in generation, including the lightning network, aim to improve the scalability and transaction pace of Bitcoin, making it more practical for common use. In addition, growing regulatory readability in many countries should open the most broadly adopted and integration into the conventional financial system.

Conclusion

It represents a revolutionary step closer to an open, transparent, and inclusive monetary machine. Although it faces countless demanding situations, its ability to interrupt traditional finances cannot be neglected. Whether like a price store, a means of exchange, or a hedge against inflation, Bitcoin continues to draw the attention of investors, technologists, and policymakers. As the sector actions towards a virtual destination, it is likely that its position in the formation of the monetary landscape will grow, making it one of the most generalized innovations of the 21st century.

Frequently Asked Questions (FAQs)

Is Bitcoin better than gold?

Bitcoin is simpler to carry, divide, and transfer, but gold is more solid and extensively common.

Can Bitcoin update the United States greenback?

How does Bitcoin shield in competition to inflation?

Bitcoin has a limited distribution of 21 million coins, which makes it evidence against inflation.